ProActive Cyber Insurance

Dynamic insurance with proactive risk detection to mitigate potential cyber-attacks.

Dynamic insurance with proactive risk detection to mitigate potential cyber-attacks.

In damage caused by cyberattacks by 2025 at the current rate of growth.

Ransomware attacks occurred globally in the first half of 2022.

Average Data breaches cost to businesses in 2022.

Why E-Insurer

As a leading provider of cyber insurance solutions in South Africa, E-Insurer is dedicated to enhancing insurability for both corporate and individual clients. Our comprehensive risk management system offers complete visibility into risk exposure, enabling proactive loss control and adaptive protection.

What we do for corporates

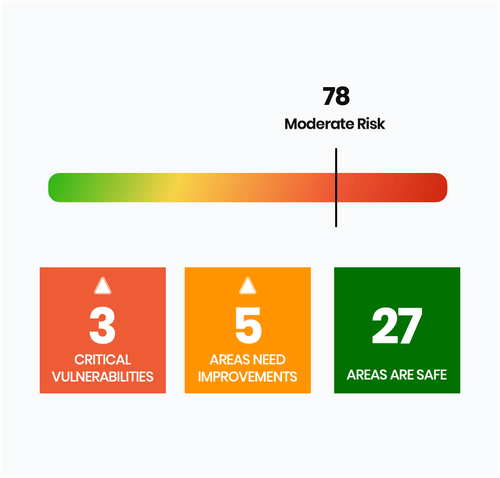

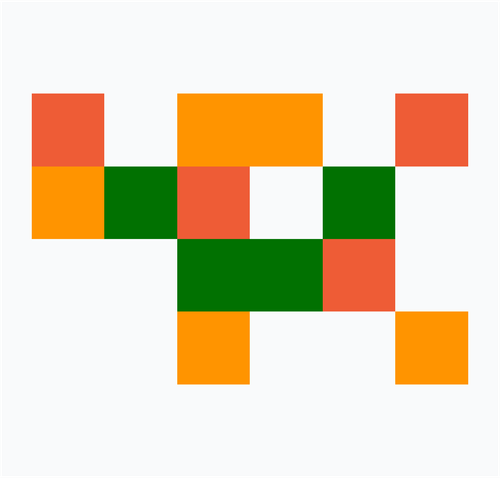

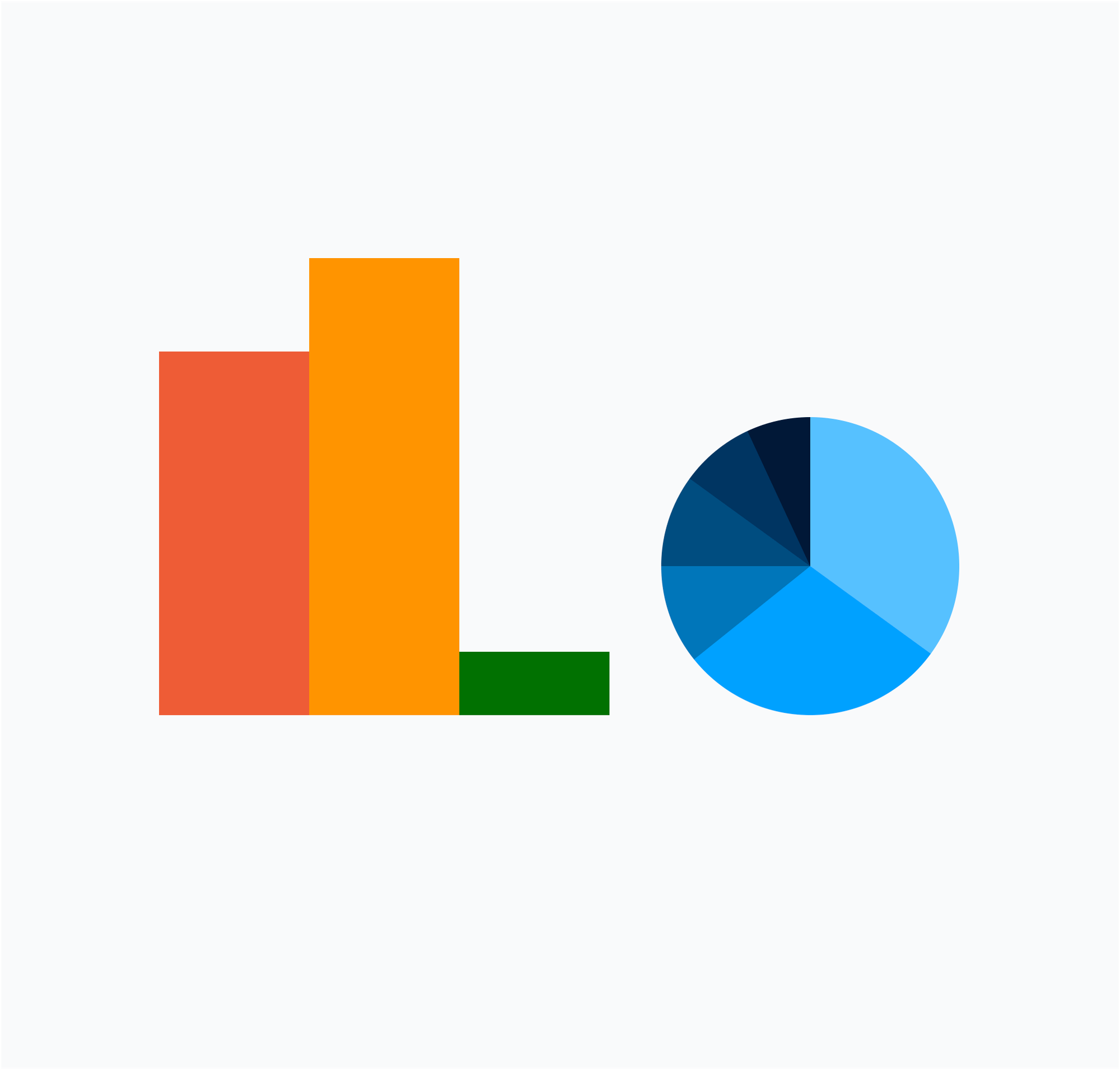

E-Insurer provides an all-encompassing risk management system designed to enhance insurability for corporate clients. We offer comprehensive visibility into risk exposure and equip clients with the tools needed to detect, evaluate, and mitigate cyber vulnerabilities across all digital touchpoints.

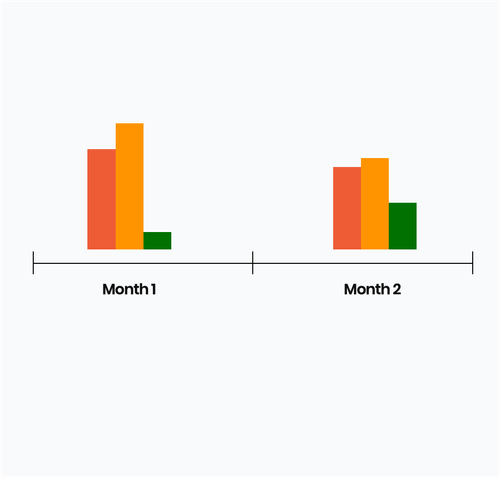

We leverage the synergy of technology and insurance to proactively identify potential risks using industry-leading technology. By providing an encompassing view of the digital risk landscape, we integrate proprietary data with cutting-edge analytics, creating a clear and accurate portrait of your organization’s ongoing and ever-changing risk profile.

Our adaptive response processes continuously evolve and adjust security measures based on an organization's risk profile and ongoing awareness of security breaches. This proactive adaptation of cybersecurity strategies effectively counters and mitigates vulnerabilities and threats.

Leveraging the synergy of technology and insurance, we aim to proactively identify potential risks using industry-leading technology.

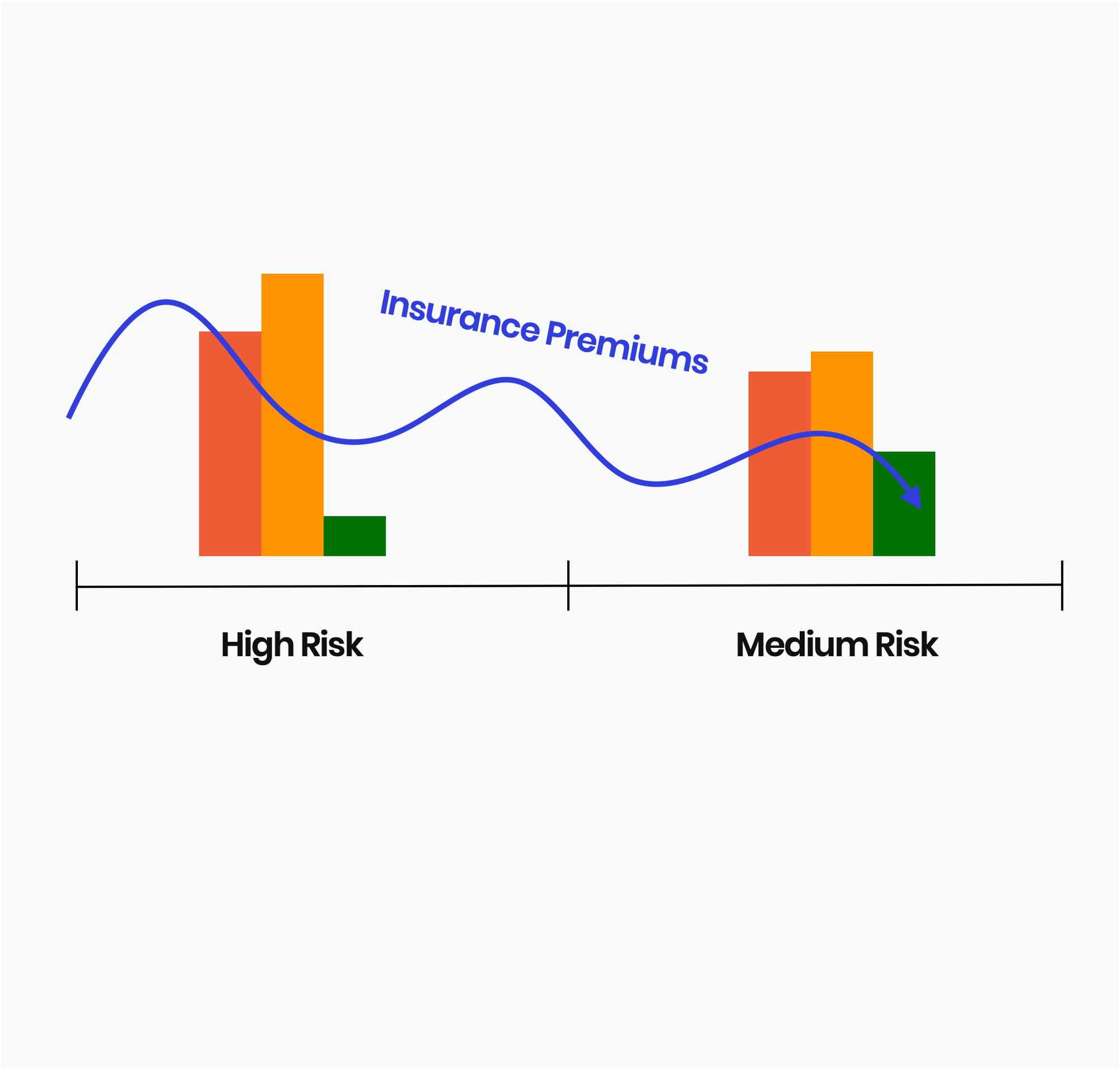

E-Insurer offers tailor-made cyber insurance policies fitting the risk profile of each client. Our coverage adapts to the ever-changing global cyber threat environment, with incentives to encourage policyholders to enhance their security measures.

We offer incentives for companies to continually improve their security posture, thus reducing the cost of insurance coverage. Motivating businesses to proactively manage and mitigate cyber risks ensures their risk profile is as strong as possible.

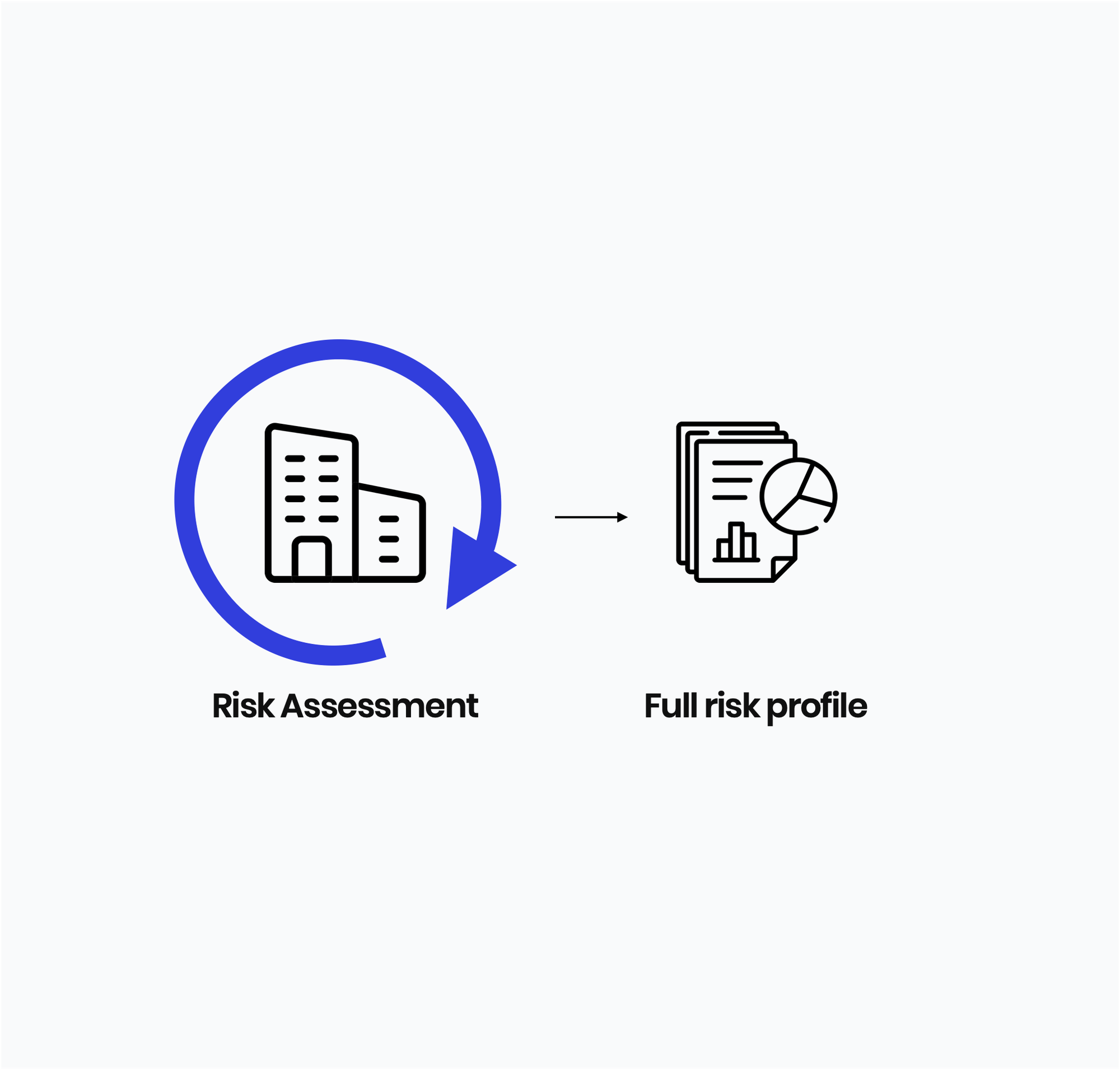

Most businesses do not fully understand their vulnerabilities. Before any strategies are created, we use industry-leading software to understand every aspect of our client's security profile, ensuring comprehensive risk assessment and management.

What we do for individuals

E-Insurer offers the most thorough cyber insurance in South Africa, designed to safeguard individuals and families from a wide array of digital threats. Our modular approach allows customization, ensuring that every family member is protected through options ranging across three distinct packages, exclusively sold with McAfee Individual & Family products.

Our policy reimburses funds lost due to a cyber incident or hacking of your bank account, payment cards, or mobile wallet. We cover the costs to investigate how the incident occurred, the funds lost, and legal fees to prosecute the third party responsible.

E-Insurer covers costs resulting from identity theft, including lost income, costs to reapply for loans, grants, or other lines of credit, and the expenses for reissuing ID documents. We provide up to six months of credit and identity theft monitoring.

Our policy covers the costs of an IT expert to restore your data and software or replace necessary parts of your computer.

We cover the fees, costs, and expenses to remove relevant online material, lost income, legal action against the perpetrator, and expert services to manage and protect your reputation. Additionally, there is an upfront payment for treating emotional trauma and costs to relocate your child to a different school if needed.

E-Insurer covers the costs for an IT expert to confirm the validity of a demand and, if appropriate, try to restore your systems and data. We will also cover ransom demands and other reasonable costs incurred to resolve the incident.

Our policy includes the costs for an IT expert to investigate incidents and the ensuing legal costs and settlements that may be awarded or agreed upon.